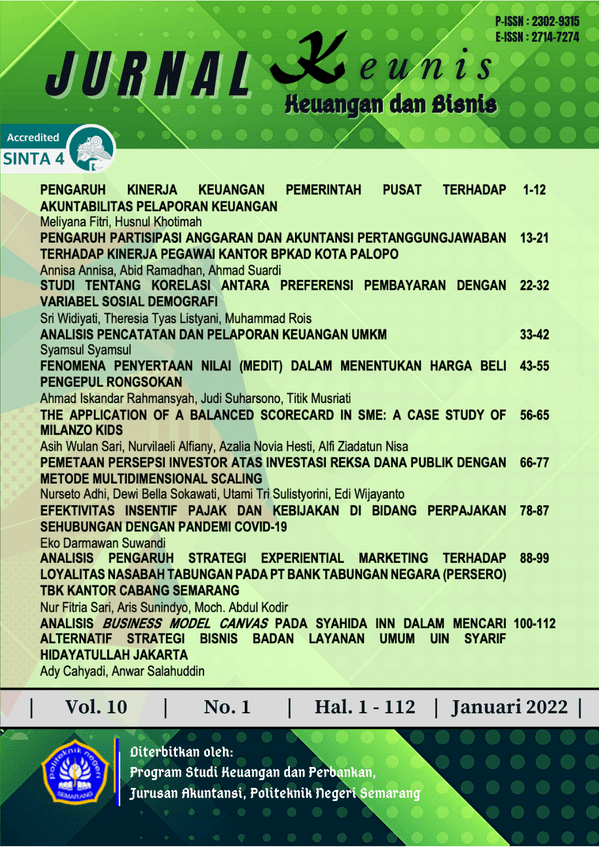

PEMETAAN PERSEPSI INVESTOR ATAS INVESTASI REKSA DANA PUBLIK DENGAN METODE MULTIDIMENSIONAL SCALING

DOI:

https://doi.org/10.32497/keunis.v10i1.3089Keywords:

perceptual mapping, mutual fund investment, multidimensional scalingAbstract

This study aims to map the position of public mutual fund products and investment managers based on the results of perceptual mapping. The samples used in this study were 5 public mutual funds and 9 investment managers in each type of public mutual fund based on the investment portfolio selected using the purposive sampling method. The method of analysis used descriptive statistical analysis and multidimensional scaling. The results of the data processing of the mutual fund product attributes are processed in Microsoft Excel which further passed through the statistical test stage of multidimensional scaling ALSCAL (Alternative Least Square Scaling) using the SPSS application. The result of the multidimensional scaling test show that the perceptual mapping is divided into 4 quadrants based on the determinant attributes of public mutual fund products. It found that 6 mutual fund products divided by Risk and Costs determinant attributes, then 6 other mutual fund products found divided by NAB/UP and return, then 4 other mutual fund products found are not divided by determinant attributes and the rest 4 other mutual fund products divided by other determinant attribute in this research.References

Bening, A. (2018). Pengaruh Pengetahuan Investor, Persepsi Risiko Dan Motivasi Terhadap Keputusan Investasi Saham Syariah (Studi Kasus Pada Investor Mahasiswa Fakultas Ekonomi Dan Bisnis Islam UIN Walisongo Semarang). Skripsi. Semarang : Universitas Islam Negeri Walisongo.

Darmadji, T dan Fakhrudin. (2006). Pasar Modal di Indonesia Pendekatan Tanya Jawab. Jakarta: Salemba Empat.

Fahmi, K. M. (2019). Pengaruh Pengetahuan Generasi Z, Persepsi, dan Fasilitas Perbankan Syariah Terhadap Preferensi Pada Bank Syariah dengan Sikap Sebagai Variabel Intervening. Skripsi. Jakarta : Universitas Islam Negeri Syarif Hidayatullah.

Ginanjar, Irlandia, (2008). Aplikasi Multidimensional Scaling Untuk Memposisikan Produk Pada Masalah Produk Existing. Surabaya: Fakultas Sains dan Teknologi Universitas Airlangga.

Ghozali, Imam., Dwi Ratmono. 2013. Analisis Multivariat dan Ekonometrika, Teori, Konsep, dan Aplikasi dengan Eviews 8. Semarang: Badan Penerbit Universitas Diponegoro.

Hsieh, H. P., Tebourbi, I., Lu, W. M., & Liu, N. Y. (2020). Mutual fund performance: The decision quality and capital magnet efficiencies. Managerial and Decision Economics, 41(5), 861”“872.

Lianti, A., & Nurul R. (2017). Analisis Perbandingan Kinerja Reksa Dana Saham Syariah dengan Reksa Dana Saham Konvensional di Indonesia. Jurnal Ekonomi Dan Bisnis, 18(2), 141-153

Manurung, Adler H. (2010). Berinvestasi, Pendirian, dan Pembubaran Reksa dana, Jakarta : PT Adler Manurung Press.

Masruroh, Aini. (2014). Konsep Dasar Investasi Reksa dana. Jurnal Sosial dan Budaya Syar-I, 1(1), 83-96.

Mubeen, S., & Jaggaiah, T. (2018). Perception Of Indian Women Investor Towards Investment In Mutual Funds. 3(1), 64”“69.

Nahar, J. (2016). Penerapan Metode Multidimensional Scaling Dalam Pemetaan Sarana Kesehatan Di Jawa Barat. Jurnal Matematika Integratif, 12(1), 43”“49.

Nazir, Mohammad. (2011). Metode Penelitian. Bogor: Penerbit Ghalia Indonesia

Prasongko, H. A. (2020). Persepsi Dan Minat Masyarakat Terhadap Investasi Pada Instrumen Keuangan (Studi Kasus Galeri Investasi Di Kota Metro). Skripsi. Metro : Institut Agama Islam Negeri. Rapista, W. (2013). Analysis Multidimensional Scaling (Studi Kasus : Persepsi Dan Preferensi Mahasiswa Terhadap Mata Kuliah Pada Jurusan Matematika Fakultas Matematika Dan Ilmu Pengetahuan Alamuniversitas Bengkulu. GRADIEN: Jurnal Ilmiah MIPA, 53(9), 1689”“1699.

Raja, M., B, J., & Ph.D. (2020). Investors ”™ Perceptions Towards Mutual Fund Schemes Investment ”“ A Study With Special Reference To Chennai City. 11(5), 299”“306.

Sachdeva, M. S., Bhatia, M. M., & Kalra, M. R. (2013). Behavioural Effect of Mutual Fund Investor ”™ s and Perception in Millenium City. Pacific Business Review International, 5(11), 89”“97.

Shakeel, M., & Chaudhry, S. (2013). Attribute Based Preference & Predictability Of Mutual Funds for Investment by Investment Professionals: A Study From Emerging Market. European Journal of Innovative Business Management, 1, 17”“26.

Shakeel, M., & Chaudhry, S. (2015). Attribute-Based Perceptual Mapping Of Mutual Fund Schemes : A Study From An Emerging Market. International Journal Economics And Business Research, 10(1), 81”“103.

Sharma, N. (2012). Indian Investor ”™ s Perception towards Mutual Funds. Business Management Dynamics, 2(2), 1”“9.

Simamora, B. (2005). Analisis Mulivariat Pemasaran Edisi Pertama. Jakarta: PT. Gramedia Pustaka Utama.

Singh, B. K. (2012). A study on investors ”™ attitude towards mutual funds as an investment option. International Journal of Research in Management, 61”“70.

Sugiyono. (2014). Metode Penelitian Pendidikan Pendekatan Kuantitatif, Kualitatif, dan R&D. Bandung: Alfabeta

Sulistyorini, Utami Tri. (2017). Metode Penelitian Analisis Kausal-Regresi. Semarang: Politeknik Negeri Semarang.

Sumin. (2017). Penerapan Analisis Multidimensional Scaling untuk Memetakan Persepsi Stakeholders Terhadap Mutu Lulusan Iain Pontianak. Jurnal Pemikiran Pendidikan Islam Journal, 11(2), 97”“104.

Tandelilin, E. (2017). Pasar Modal: Manajemen Portofolio dan Investasi. Yogyakarta: PT Kanisius.

Ulinnuha, M., Susilowati, D. E., & Hana, K. F. (2020). Persepsi Investor Pemula Terhadap Pembelian Saham Syariah di Indonesia. Jurnal Ilmu Ekonomi Dan Bisnis slam, 2(1), 1”“14.

Umar, Husein. (2013). Metode Penelitian untuk Skripsi dan Tesis Bisnis Edisi Kedua. Jakarta: Rajawali Pers

www. sikapiuangmu.ojk.go.id, diakses pada tanggal 28 April 2021

www.reksadana.ojk.go.id, diakses pada tanggal 30 Juni 2021

www.pasardana.id, diakses pada tanggal 30 Juni 2021

www. bareksa.com, diakses pada tanggal 30 Juni 2021

Downloads

Published

How to Cite

Issue

Section

License

KEUNIS is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).